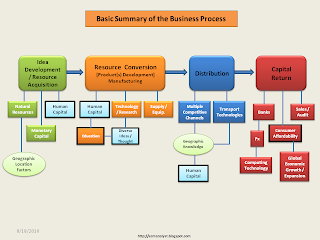

Value to business is its ability to provide a utility of offering(s) to its targeted customer base with expansion through an increasing number of consumers. Accomplishing this requires ongoing improvement in knowledge of product utility, consumer usage, and the economic and social engagement of the employed human capital. Effective implementations will ultimately result in a growing enterprise with consumer recognition of proactive attention to market(s) served. Growth is an important focus of investment managers and market strategists in the determination of business (corporate) valuation and investment decision metrics. Most growth expectations are revenue (sales) based which flow to net earnings in a consistent, efficient operation [margin improvement]. However, growth in earnings (bottom-line) with flat periodic sales (top-line) is a reflection of operational or capital structure improvements. In an effort to review some common finance evaluative metrics used in business decisions, I have added them to the categories on the Basic Summary of the Business Process graphic. A few important observations to note:

1) Cash Flow and Return are specific to evaluations of Income (earnings) which include tax implications relative to ownership distributions;

2) Turnover metrics evaluate sales volume relative to distribution and operational efficiencies.

3) Equity Valuations specific to publicly traded stocks depend heavily on growth compared to expected returns compared to industry peers.

4) Return on tax liabilities rendered is not a metric!

Prior to making project investment decisions, each corporation has an analysis benchmark to satisfy expectation of return on invested capital. Growth is part of the evaluation and as evident in the listed metrics, the analysis is firm specific. So, what is the source of growth? New products or services? Competitive product defeat? Vertical or horizontal business combinations? Increased consumer consumption? New markets (domestic or international)? Is the industry growing or shrinking?

Each answer has an implication on the economy, policy, and overall employment levels. They also reflect the differing objectives and directives between Corporations and Governments. Business finance decisions tend to be very firm specific while governments must maintain the rules of fairness and policies to support balanced, sustainable economic growth of opportunities for all citizens to prevent social disruptions due to biased misallocations. While corporations look for revenue and earnings growth via new customers/consumers and operational efficiencies to improve the retention of each sales dollar received, governments are looking to invest in projects that improve the lives of citizens through educational access and services to maintain certain standards of humanity. Additionally, governments ensure equal and fair citizen access to the necessary resources for improvement to livelihoods through market creating rules & conditions and the collection of taxes from beneficial commerce of infrastructure investment. When domestic sales growth slows, companies generally look in other geographic locations for opportunities. Investment in local under-served communities is also an opportunity for additional consumer development; however, many companies do not consider the investment due to the longer duration in payback (return on investment) of population educational improvements and wage increases. Two things governments can accomplish from collected taxes are the re-allocation of investments into education & skill development as well as targeted technology research to match and create marketplace opportunities. Just as business looks to maximize return on investment, governments should invest in the societal groups that stand to gain, or improve, the most (those below normal standards). Diversity in investment will yield diversity in ideas, developments, thoughts, innovation, and achievement.

Basic Summary of Business Process

As America and the rest of the world work through the current recessionary period, reflection back on the methods of development which created our strongest economic base is necessary. Contrary to some positions communicated on TV talk shows, the government has historically always been involved with the vast expansion of economic developments beneficial to our society. If the government is not considered one of the initial “investors” in the technological development with infrastructure, funding the university system, and providing grants for research, then it is the creator of the evolving American marketplace. Alexander Graham Bell and Thomas Edison are credited for the telephone and electricity, respectively. However, it was the national installation of the wire line and electric grid that provided for the product application with benefits of immense growth to society. Aside from the current struggles in Detroit, the highway and interstate infrastructure really contributed to the success of the automobile industry. The same argument can be made for the railways and aircraft industry with airports.

The necessary market developments that induce mass adoption of a new technology or invention do not always compute in the financial analysis from business (ROI, ROA, Payback, and Cash Flow). It is the forward looking recognition and contribution of the government that make the difference. This is why it matters where and how the government spends its money. Wise investments for one industry’s infrastructure could possibly spawn two or three other industries. When industry will not spend money and invest during times of declining employment levels, it appears to me that two options are available: 1) Government makes the investment [possibly creating and developing the business with unemployed business people for later sale to other investors] or 2) Change industry rules and standards for the current businesses to invest in change to adopt.

Many good ideas have been published on where best to spend stimulus to create jobs. I do not intend to duplicate so any repeat is coincidental with similar thinking. The following is just a personal list of items of where I think the country should focus for development and I will attempt to place in the order I believe to have the most immediate impact:

1. Construction, repair, and inspection of the nation’s bridges and roadways.

2. Small Business Lending institutions for grants to business creation by entrepreneurs not served by the current banking system (An addendum to the SBA activities and agenda).

3. Sponsorship of the razing of abandoned buildings throughout the country not suitable for future usage. Although not the same emotional value as constructing a new building, it will reduce despair by passersby and remove the negative image. Maybe Hollywood would be interested in the destruction of some buildings and could offset costs [referring to abandoned industrial buildings no longer in use].

4. Sponsorship for the installation of electric charging stations for current and upcoming hybrid automobiles. Hotels and motels appear to be obvious locations but maybe there are other ideas to consider.

5. Introduce regulations and standards for safe, efficient, and universal maintenance of medical records with patient portability.

6. Adopt the standards conducive to the development of a “green” infrastructure:

a) Increase vehicle fleet mileage standards;

b) Improve fuel efficiency and gasoline octane standards;

c) Pollution limits, adopt "cleaner" coal standards, improve electricity generation efficiencies (similar to average fleet mileage standards – reduce average generation costs including cost of pollution).

7. Continue investment in university and college research toward targeted fields such as “green” energy, non-biodegradable plastics alternative, targeted biomedical projects, and new uses for the future abandoned telephone wire lines.

I am sure there will be other opinions because not many want to change the current way business is conducted until the model does not earn as expected. However, when the model stops earning as expected it is usually a sign of the end and is often too late to avoid dissolution or restructuring. I also realize that financial measures such as return are not totally applicable to management of government affairs, but another way to look at the arguments against government involvement is to question whether or not industry has returned in taxes the equivalent to expected return on investment/equity for its benefit from infrastructure development and maintenance.

![Reblog this post [with Zemanta]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_stVjKhXXFaMyQq5EdaS5_zkM1gOczZHFyLipm-vwKWQu7r86F242_j6A3kB5BiUrVuEm2cBWR7-phB3x7m2z555TKEE5JcQvdZBWw-I-eAErUn3ssrsCountYf47wsQJ36yNIEE7RCsBZbBevVlnEU=s0-d)

+Metrics.png)