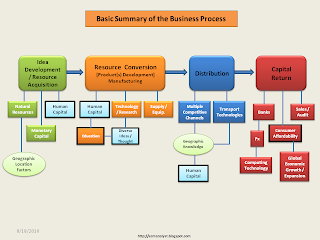

Value to business is its ability to provide a utility of offering(s) to its targeted customer base with expansion through an increasing number of consumers. Accomplishing this requires ongoing improvement in knowledge of product utility, consumer usage, and the economic and social engagement of the employed human capital. Effective implementations will ultimately result in a growing enterprise with consumer recognition of proactive attention to market(s) served. Growth is an important focus of investment managers and market strategists in the determination of business (corporate) valuation and investment decision metrics. Most growth expectations are revenue (sales) based which flow to net earnings in a consistent, efficient operation [margin improvement]. However, growth in earnings (bottom-line) with flat periodic sales (top-line) is a reflection of operational or capital structure improvements. In an effort to review some common finance evaluative metrics used in business decisions, I have added them to the categories on the Basic Summary of the Business Process graphic. A few important observations to note:

1) Cash Flow and Return are specific to evaluations of Income (earnings) which include tax implications relative to ownership distributions;

2) Turnover metrics evaluate sales volume relative to distribution and operational efficiencies.

3) Equity Valuations specific to publicly traded stocks depend heavily on growth compared to expected returns compared to industry peers.

4) Return on tax liabilities rendered is not a metric!

Each answer has an implication on the economy, policy, and overall employment levels. They also reflect the differing objectives and directives between Corporations and Governments. Business finance decisions tend to be very firm specific while governments must maintain the rules of fairness and policies to support balanced, sustainable economic growth of opportunities for all citizens to prevent social disruptions due to biased misallocations. While corporations look for revenue and earnings growth via new customers/consumers and operational efficiencies to improve the retention of each sales dollar received, governments are looking to invest in projects that improve the lives of citizens through educational access and services to maintain certain standards of humanity. Additionally, governments ensure equal and fair citizen access to the necessary resources for improvement to livelihoods through market creating rules & conditions and the collection of taxes from beneficial commerce of infrastructure investment. When domestic sales growth slows, companies generally look in other geographic locations for opportunities. Investment in local under-served communities is also an opportunity for additional consumer development; however, many companies do not consider the investment due to the longer duration in payback (return on investment) of population educational improvements and wage increases. Two things governments can accomplish from collected taxes are the re-allocation of investments into education & skill development as well as targeted technology research to match and create marketplace opportunities. Just as business looks to maximize return on investment, governments should invest in the societal groups that stand to gain, or improve, the most (those below normal standards). Diversity in investment will yield diversity in ideas, developments, thoughts, innovation, and achievement.

Basic Summary of Business Process

+Metrics.png)