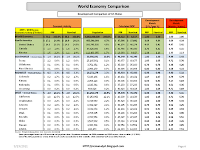

Organization for Economic Co-operation and

Development (OECD) has a 35

nation membership and provides economic analysis and guidance in an effort to

sustain open democratic governance with a mission to promote policies that will

improve economic and social well-being of people around the world. This

analysis of R&D spending is one of the many reports issued by OECD and

reflects country spending relative to GDP which provides an indicator of future

technological development within society. The associated national wealth is

measured through patents and patent protections for development of the

technological breakthroughs for ownership claims of corporate and industry

developments for expansive application around the world. Included is the use of

military R&D for national defense which can have application within social

technology usage and country business

systems.

The analysis measurement is R&D spending as a percent of

GDP and although other nations may have a higher spending rate than the United

States, the United States still spends more on a dollar basis due to the larger

economy.

"The United States, which spends more than any other country on R&D and accounts for around 40% of total OECD R&D expenditure, saw its R&D intensity rise slightly from 2.76% in 2014 to 2.79% in 2015. Meanwhile, China continued its steady increase in R&D intensity, reaching 2.1% in 2015 – only 0.3 of a percentage point below the OECD average. In volume terms, China’s R&D spending was equivalent to 81% of the United States level in 2015 and 9% higher than that of the EU. The latest patent data show the number of patents filed by Chinese inventors continued to rise in 2014, while filings under the Patent Cooperation Treaty by United States inventors declined."

.PNG)

.PNG)