The American image has long been that of a “melting pot” [collective inclusion] of cultures in the land of Democracy (rule by the people). The description is accurate in that the country does include a multitude of ethnicities and cultures combining into the American society. The late 1960s was a time of dramatic cultural change breaking barriers that prevented social collaboration and social integration of the people. Honestly, I believe that the majority of Americans favor diversity and accept interrelations setting aside the hidden economic-corporate social limitation (J.E."Hooverites" secret social policy). Politically they tend to be concentrated in the larger metropolitan areas in America. A conservative coalition has been working to reverse those impacts of change as evident in political public statements and positions referencing days of an era past using religious-economic theory and application, if not completely through legislation. Conservative ideology has strong associations in Southern politics still supporting a broader sense of ideological segregation. Consistent with this ideology embedded in religious confirmations and historical references include recognition of historical “Religious Order” and a reincarnated influence in certain American institutions.

Support for this organizing concept is the expanded structure fraternal system adapted for use by an expanded definition of “Church” assisting in acts and organization. This line of reasoning would affect understanding of relationships between Corporations, Religious Institutions, and Political-Governing-Intelligence systems in violation of Constitutional Democratic principles and provide enlightenment regarding the current population employment status. Most political discussions focus on a racism prospective of Conservatism which does not completely reflect the correct mental framing and allows defense of the criticism using friendly associations. The Conservative perspective is consistent with a “Hierarchal Order” which explains opposition to Diversity, Interracial/Inter-ethnic relationships and leadership, balanced (competitive) ownership of economic resources, and provisions for minimum living standards of humanity (they labeled “socialism”). Furthermore, the “Order” concept is based upon a male controlled “family” leadership economic model allowing the directed subjugation of women and children which would explain infallible individual design; racial “moral traps”; socialization of Black “family” commitment politics; African religious tradition; equality opposition; and sex exploitation to maintain “order.” Using the stated conservative belief in “exceptionalism” overlays the “Order Hierarchy” relationship to global political science. The real question is “Do the ‘Order’ and ‘exceptionalism’ concepts refer to the American systems or the American people?”

The southern influential base of conservative politics is well known and documented. What does not get examined is the impact on Black American politics, education, and intellectual development resulting from historical social location concentration origins in the South. Successful economic ascension after legal rights recognition impacted authority structures including historical “Order” and “family” conceptual definitions. This culturalization of Black America affected identity definitions, expected social behaviors, and economic distributions relative to religious tradition adoptions and cooptation of the Black “family” meaning. Reflected in my blog post themes is recognition of African and Native origins in the populations throughout the Americas commonly referred to as people of color and my new influenced interest in United States Latino colleagues’ cultural history. Unless there is another (prophetic? social policy) reason, the African designated identity specification is redundant particularly given the scientific testing explanation acceptance of the earliest known developments which leads to question the African tradition testimony, purpose of fallibility, ethnic segmentation, and religious emphasis on submission to power and authority. Is this a Southern learned leadership attribute of “dues” or reflection of subjugated frustration? A sample illustration of this social system is reflected in the comparative extrapolation of Classic Conditioning supported by the relationships among Black American fraternal organizations, religion, psychology, corporations, politics, and certain government agencies:

(Used for Inter-ethnic Relationship Separation through "Church," Corporations, & Politics - Economics and “Order” Concept)

Social Conditioning

Social Conditioning refers to the sociological phenomena characterized by a process of inherited tradition and gradual cultural transmutation passed down through previous generations. Results and impacts of social conditioning are vast, but they are generally categorized as social patterns and social structures.

Shaping

In operant conditioning, the subject must first emit the response that the experimenter plans to reward. Shaping is the name given to those initial steps needed to get the subject to engage in the behavior that is to be rewarded.

Not consistent with religion, enlightenment, and constitutional rights! Conditioning is also reflected in interrelated roles of Corporations, Churches, and political-morality-fraternal order. Evident in clandestine communications monitoring and moral exploitation setups for covert domestic political actions liability coordinated through Southern Social "Family" Councils. These acts all serve the "Solid South" and conservative ideology designed around early segregation and economic order (discrimination) to create an interpreted biblical authority structure and allows the “triangle” manipulation of personal outcomes to blame on a constructed individual morality. Religion is personal!

In the Aerospace industry during times of routine inspection, repair, or overhaul, a process called reverse engineering is employed whenever mechanical aircraft parts are needed without proprietary authority from the creator (OEM) to access design and no inventory. This generally means attempted replication of the original part using trial and error and sometimes original materials are not available. The result is an inexact copy of the original, evolved design of differing (usually lesser) specification standards. This example metaphorically relates to Black “Family” or any other "family" forced solidarity commitment to pacify conservative social reasoning. It is an economical power threat to current ownership profitability and “order” to establish pay equity (gender & ethnicity economic equality) than it is to create or allow 10+ “Family” billionaires.

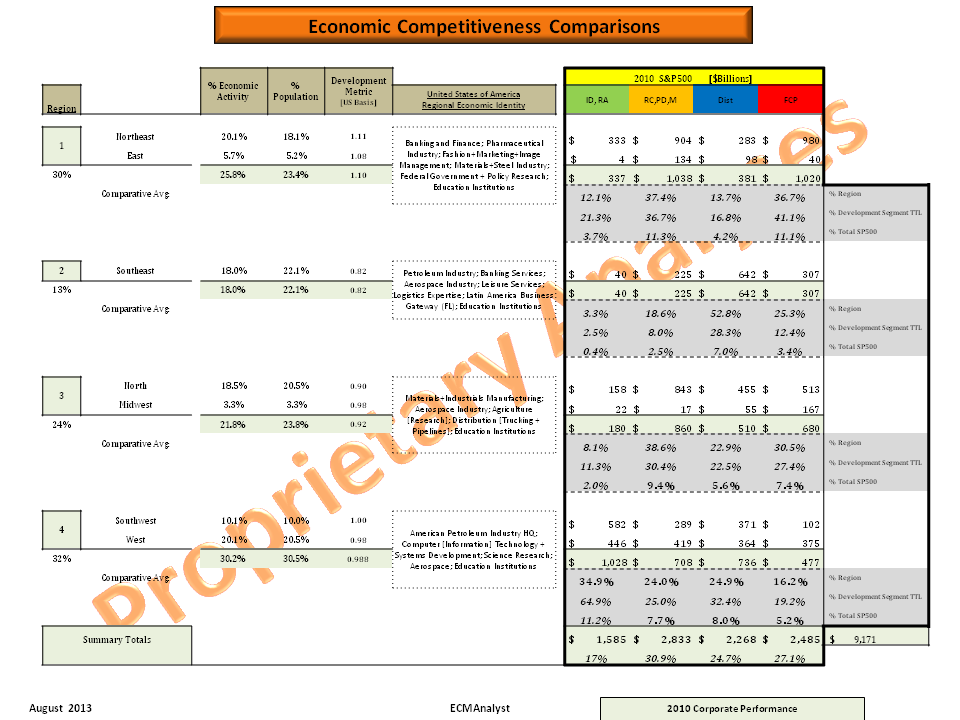

Concentrated employment control politics has increased unemployment to leverage tax breaks. According to definitive financial theory, required tax reduction to increase employment of capital would indicate that ownership is too concentrated and companies are too big to obtain adequate market returns.

Economic Terms of “Order” and “Family” Concept:

"Family?" Inheritance