The Issue with "Trickle Down" Ideology

Historical economic development of natural resources provided for the continuous improvement of living conditions of humanity through agricultural production, housing, fuels, transportation, and electricity generation among others. Early scale development allowed producers to efficiently grow and provide goods and services for the larger U.S. market. The basis for focused growth was expansion of available skills, training, and education. As human capital development expanded so did opportunities for economic growth and specialization. Consistent with the economic expansion was an evolving, socially inclusive based capital investment allocation via financial markets, entrepreneurial investors, and governments (federal and state). Inclusion of the larger population accelerated market growth and size through expanded wealth distribution and consumption.

Contrary to Democratic societal systems of capitalism, “Trickle Down” economic strategies attempt to consolidate financial capital within a market structure where allocation is focused solely on directed return interests. Benefits of the system "trickle down" to all other economic interests relative to the relationship to financial capital ownership. Another aspect of the ideology is the reduced role of government investment in industry via scientific research and education to provide a more distinctive limitation of Government - Industry regulatory inter-relations. The result of this strategy success would be the accumulation of financial capital within a single industry to determine investment decisions based upon a technical return calculation. Moreover, the country would be further segmented into economic benefit groups relative to development contribution factors limiting economic mobility opportunities.

An example of capital return benefits accumulation follows using a hypothetical scenario of citizen savings/investment and profit (return) distribution given a set of financial industry deposit decisions. In an attempt to reduce complexity, the scenario is based upon the Basic Summary of Business Process graphic presented in earlier discussions. The example analysis basis is the distribution of return on investment within the value chain of banking industry under the “Trickle Down” ideology of capital investment allocations and monetary concentrations (“bubbles”). The example reflects a regional commercial bank return of 15.4% based upon a loan with a 6.8% yield. The difference between the two returns is the accounting calculation. The bank transaction on the balance sheet would include a liability of $1,000,000 (savings/deposit) and assets of $900,000 (IB investment) for a net liability of $100,000 and profit on the liability of $78,503. However, the major point is the difference in return between the savings/investor and the banks (State and Federal Chartered/IB/Hedge Funds) where the proportion of profit sharing may vary somewhere between the 2.5% and 34.9% spread. Explicit in the example are the impacts of pricing gains (valuation) from increasing investment monetary levels and the beneficiaries resulting from the increase and the investment decisions relative to other opportunities. The financial capital concentration signals the need for an adjusted financial system model of “grant” awards identification and investment allocations into other development opportunities greatly expanding the focus.

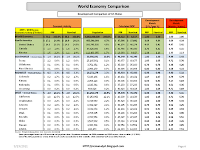

Graphic documents support and reflect the relationship of topic themes previously discussed for comparison with social organizations, structure, and decision outcome impacts from general stereotype beliefs. I am planning to update the earnings data chart in which I applied the Development Metric methodology for additional commentary on human values, resources and ownership, and limitations (morality) of contractual (industry) terms agreement.