Website Translator

Showing posts with label economic policy. Show all posts

Showing posts with label economic policy. Show all posts

July 30, 2011

Governance Perspectives and Development

June 24, 2011

January 16, 2011

Development and Economic Policy

The Issue with "Trickle Down" Ideology

Historical economic development of natural resources provided for the continuous improvement of living conditions of humanity through agricultural production, housing, fuels, transportation, and electricity generation among others. Early scale development allowed producers to efficiently grow and provide goods and services for the larger U.S. market. The basis for focused growth was expansion of available skills, training, and education. As human capital development expanded so did opportunities for economic growth and specialization. Consistent with the economic expansion was an evolving, socially inclusive based capital investment allocation via financial markets, entrepreneurial investors, and governments (federal and state). Inclusion of the larger population accelerated market growth and size through expanded wealth distribution and consumption.

Contrary to Democratic societal systems of capitalism, “Trickle Down” economic strategies attempt to consolidate financial capital within a market structure where allocation is focused solely on directed return interests. Benefits of the system "trickle down" to all other economic interests relative to the relationship to financial capital ownership. Another aspect of the ideology is the reduced role of government investment in industry via scientific research and education to provide a more distinctive limitation of Government - Industry regulatory inter-relations. The result of this strategy success would be the accumulation of financial capital within a single industry to determine investment decisions based upon a technical return calculation. Moreover, the country would be further segmented into economic benefit groups relative to development contribution factors limiting economic mobility opportunities.

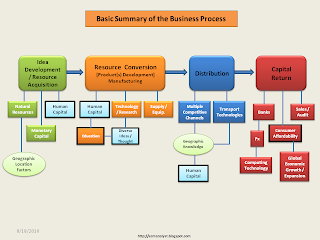

An example of capital return benefits accumulation follows using a hypothetical scenario of citizen savings/investment and profit (return) distribution given a set of financial industry deposit decisions. In an attempt to reduce complexity, the scenario is based upon the Basic Summary of Business Process graphic presented in earlier discussions. The example analysis basis is the distribution of return on investment within the value chain of banking industry under the “Trickle Down” ideology of capital investment allocations and monetary concentrations (“bubbles”). The example reflects a regional commercial bank return of 15.4% based upon a loan with a 6.8% yield. The difference between the two returns is the accounting calculation. The bank transaction on the balance sheet would include a liability of $1,000,000 (savings/deposit) and assets of $900,000 (IB investment) for a net liability of $100,000 and profit on the liability of $78,503. However, the major point is the difference in return between the savings/investor and the banks (State and Federal Chartered/IB/Hedge Funds) where the proportion of profit sharing may vary somewhere between the 2.5% and 34.9% spread. Explicit in the example are the impacts of pricing gains (valuation) from increasing investment monetary levels and the beneficiaries resulting from the increase and the investment decisions relative to other opportunities. The financial capital concentration signals the need for an adjusted financial system model of “grant” awards identification and investment allocations into other development opportunities greatly expanding the focus.

Graphic documents support and reflect the relationship of topic themes previously discussed for comparison with social organizations, structure, and decision outcome impacts from general stereotype beliefs. I am planning to update the earnings data chart in which I applied the Development Metric methodology for additional commentary on human values, resources and ownership, and limitations (morality) of contractual (industry) terms agreement.

December 1, 2010

Analysis and Indicators Usage

Usage of the indicators, statistics, charts & graphs to reinforce an explained perspective and policy position is very common to discussions regarding deciphering economy and policy decisions. Just to ensure understanding that the discussion support data and indicators match the inferences made, here are the indicator definitions with a few examples of each type.

(1) Leading indicators (such as new orders for consumer durables, net business formation, and share prices) that attempt to predict the economy's direction;

(2) Coincident indicators (such as gross domestic product, employment levels, retail sales) that show up together with the occurrence of associated economic activity; and

(3) Lagging indicators (such as gross national product, consumer price index, interest rates) that become apparent only after the occurrence of associated economic activity.

http://www.businessdictionary.com/definition/economic-indicators.html

http://en.wikipedia.org/wiki/Economic_indicators

November 8, 2010

Growth, Revenue & Profit Sources

Value to business is its ability to provide a utility of offering(s) to its targeted customer base with expansion through an increasing number of consumers. Accomplishing this requires ongoing improvement in knowledge of product utility, consumer usage, and the economic and social engagement of the employed human capital. Effective implementations will ultimately result in a growing enterprise with consumer recognition of proactive attention to market(s) served. Growth is an important focus of investment managers and market strategists in the determination of business (corporate) valuation and investment decision metrics. Most growth expectations are revenue (sales) based which flow to net earnings in a consistent, efficient operation [margin improvement]. However, growth in earnings (bottom-line) with flat periodic sales (top-line) is a reflection of operational or capital structure improvements. In an effort to review some common finance evaluative metrics used in business decisions, I have added them to the categories on the Basic Summary of the Business Process graphic. A few important observations to note:

1) Cash Flow and Return are specific to evaluations of Income (earnings) which include tax implications relative to ownership distributions;

2) Turnover metrics evaluate sales volume relative to distribution and operational efficiencies.

3) Equity Valuations specific to publicly traded stocks depend heavily on growth compared to expected returns compared to industry peers.

4) Return on tax liabilities rendered is not a metric!

Each answer has an implication on the economy, policy, and overall employment levels. They also reflect the differing objectives and directives between Corporations and Governments. Business finance decisions tend to be very firm specific while governments must maintain the rules of fairness and policies to support balanced, sustainable economic growth of opportunities for all citizens to prevent social disruptions due to biased misallocations. While corporations look for revenue and earnings growth via new customers/consumers and operational efficiencies to improve the retention of each sales dollar received, governments are looking to invest in projects that improve the lives of citizens through educational access and services to maintain certain standards of humanity. Additionally, governments ensure equal and fair citizen access to the necessary resources for improvement to livelihoods through market creating rules & conditions and the collection of taxes from beneficial commerce of infrastructure investment. When domestic sales growth slows, companies generally look in other geographic locations for opportunities. Investment in local under-served communities is also an opportunity for additional consumer development; however, many companies do not consider the investment due to the longer duration in payback (return on investment) of population educational improvements and wage increases. Two things governments can accomplish from collected taxes are the re-allocation of investments into education & skill development as well as targeted technology research to match and create marketplace opportunities. Just as business looks to maximize return on investment, governments should invest in the societal groups that stand to gain, or improve, the most (those below normal standards). Diversity in investment will yield diversity in ideas, developments, thoughts, innovation, and achievement.

Basic Summary of Business Process

August 9, 2010

Latin America GDP Analysis

Earlier blog discussions centered around economics and social designations relative to the united society creating the United States. Comparisons were made to primarily European countries and I wanted to complete the perspective by including Latin America. The data also provides a clear view of the immigration topic relative to our neighbors in the Americas south of US.

Slides: Latin America GDP Comparison [revised]

Related Topic Website:

Related Blog Posts:

July 28, 2010

Economic Policy and System Money Flows

Previous blog posts have discussed inequality and the current changes being experienced throughout the American economy. I put together a simple graphic presentation of how I see the impact of economic policies and the money flowing through the financial system as it relates to the American populace. An actual representation is a lot more complex than this graphic depicts, but this does reflect the basic impact of the differing philosophical economic policies. I am open to discuss other interpretations and possible oversights.

July 11, 2010

Historical Connections? Part 2

The United States society and economy really began to distinguish itself during and after WWII. The war required change in social policy allowing the inclusion of all members of society to contribute to the build of necessary industry support. This inclusive policy also allowed Latin American immigrants to join the effort in the United States contributing to increased earnings distribution and wealth across American communities. The expansion of industry and labor (skill development) aided the economy during increased worldwide industrial demand from capacity impacted regions after the war. The quarter century or more after WWII redefined the American society from the church to the military defense build-up strategies for US interests to include all citizens and share economic prosperity.

WWII also provided the early need for integration initiatives ultimately leading to Civil Rights legislation of the 1960’s. Although serving in segregated units, the soldiers proved to be exceptional contributors to the US efforts despite fears of enemy cooptation. These fears were promoted within the conservative circles of the military contributing to the limited usage of the diverse manpower and reflected the prevailing psychology of Conservative protection ideology. Protection through the need for precise and insulated organizational structures; the new Homeland security developments; current forced adoption of order through war actions (Middle East); and an overestimated need to conserve capital resources. Many of the human projections were derived from stereotypical assessments as evidenced in the correlation among the social structure; community economic impacts; and morality definitions to preserve human ethnic identifications (DNA vulnerabilities).

Although I am briefly introducing the topic of stereotypes and impacts here, I plan a future blog post to clarify the personal assessment analysis connecting fraternal organizations and social relationships. My perspective is obviously that of a "Black" American male (w/ Native ancestry) growing as a youth in the American South during the integration policy introduction. I am relating personal observations & experiences, reading of history, and stories heard to eventual social outcomes. During that period of the 1st generation integration, much time and energy was spent trying to prove against a critique of inability to perform [any task outside of manual labor - assumptive human capital value] ignoring the variability in relative levels and quality of education and experience of the time. The social integration resistance was supplemental to the efforts to prevent further sexual, racial interrelations by limiting the desirable mate trait appeals of intelligence and economic success. Current day impacts are the conservative emphasis of “family values” and the fallible individual morality related to sexual activity, particularly interracial. The Latino stereotype consistent with this labor social impact is the association with non-citizenship and “illegal status.” Counter to the promotion of prosperity is the moral fallibility design that is comparable to the Black church traditions/expectations to provide support and spiritual comfort for those actions deemed “short of God” by "decision makers" [with no mention of involvement, corporate influence, or Florida connections]. Moreover, the design reflects the American cultural differences with large, continental African family traditions. Given this history and traditional role, exploitation of stereotypes is consistent with activities indentified in the J. Edgar Hoover autobiography, The Man and The Secrets (ISBN-13: 9780393321289), of “political pressure” based upon documented sex lives (many stories that are not true) in files using tactics described in the 1976 Church Committee findings with relevance to current day internet technology.

Looking back at the 2006 Marriage data tables in my Gatekeepers and Modes of Incorporation and Integrative Social and Economic Systems blog posts provide at least one reason for the separatists' position (unless they are willing to admit some other human difference). Males outnumber females in the White and Latino/Hispanic racial groups by a combined 2.745 million according to census data. Black women outnumber Black males by 1.2 million encouraging further belief of the stereotypes. It appears the gender with the numerical advantage of greater mate choices tend to receive the more negative behavioral stereotype. The imbalance provides less incentive to stay committed upon discovery of deeper personality differences among mates not including social progress of equality and can impact leadership judgments in certain environments. The additional competition from others only compounds the imbalance in smaller communities. Moreover, the lack of available male mates support the dependence of non-married Black women on spiritual reliance of the church and emotional connections to its Male leadership (I give this perspective from perceptions outside the formal organization and have no intentions of changing positions or activity relative to this explanation). As with stereotypes and impacts, concept expansion of the church definition (and “God hierarchy”) will come in a future blog post. I am not sure how many others support my positions, but I do believe there are many others for varying reasons. However, my position is based upon constitutional rights, desired relationships of mutual agreement, partnership and definitely not for any fraternal (“family”) manipulative, sexually exploitative use of women.

The 1st generation of adults to integrate U.S. society after legal changes for inclusion now views the next generation partially through the lenses of personal experiences of required compromises for career advancement and assimilation. During my youth, most of the adults within my sphere of influence developed careers within government institutions such as local and state police associations; fraternal acceptance; and military groups (Army, Air Force) where strict adherence to defined rules is the standard. Such societal strict adherence allows perpetuation of Hoover type activities. This next generation has grown up incorporating the policy of inclusion and freedoms without compromise of rights. These progressive, inclusive conditions and rights are expected within all social and corporate environments. Children are not required to accept ritual commitments of their parents particularly without full and complete explanation & understanding of the implication on expected rights and freedoms upon adulthood.

December 16, 2009

The Great American Business Incubator

As America and the rest of the world work through the current recessionary period, reflection back on the methods of development which created our strongest economic base is necessary. Contrary to some positions communicated on TV talk shows, the government has historically always been involved with the vast expansion of economic developments beneficial to our society. If the government is not considered one of the initial “investors” in the technological development with infrastructure, funding the university system, and providing grants for research, then it is the creator of the evolving American marketplace. Alexander Graham Bell and Thomas Edison are credited for the telephone and electricity, respectively. However, it was the national installation of the wire line and electric grid that provided for the product application with benefits of immense growth to society. Aside from the current struggles in Detroit, the highway and interstate infrastructure really contributed to the success of the automobile industry. The same argument can be made for the railways and aircraft industry with airports.

The necessary market developments that induce mass adoption of a new technology or invention do not always compute in the financial analysis from business (ROI, ROA, Payback, and Cash Flow). It is the forward looking recognition and contribution of the government that make the difference. This is why it matters where and how the government spends its money. Wise investments for one industry’s infrastructure could possibly spawn two or three other industries. When industry will not spend money and invest during times of declining employment levels, it appears to me that two options are available: 1) Government makes the investment [possibly creating and developing the business with unemployed business people for later sale to other investors] or 2) Change industry rules and standards for the current businesses to invest in change to adopt.

Many good ideas have been published on where best to spend stimulus to create jobs. I do not intend to duplicate so any repeat is coincidental with similar thinking. The following is just a personal list of items of where I think the country should focus for development and I will attempt to place in the order I believe to have the most immediate impact:

1. Construction, repair, and inspection of the nation’s bridges and roadways.

2. Small Business Lending institutions for grants to business creation by entrepreneurs not served by the current banking system (An addendum to the SBA activities and agenda).

3. Sponsorship of the razing of abandoned buildings throughout the country not suitable for future usage. Although not the same emotional value as constructing a new building, it will reduce despair by passersby and remove the negative image. Maybe Hollywood would be interested in the destruction of some buildings and could offset costs [referring to abandoned industrial buildings no longer in use].

4. Sponsorship for the installation of electric charging stations for current and upcoming hybrid automobiles. Hotels and motels appear to be obvious locations but maybe there are other ideas to consider.

5. Introduce regulations and standards for safe, efficient, and universal maintenance of medical records with patient portability.

6. Adopt the standards conducive to the development of a “green” infrastructure:

a) Increase vehicle fleet mileage standards;

b) Improve fuel efficiency and gasoline octane standards;

c) Pollution limits, adopt "cleaner" coal standards, improve electricity generation efficiencies (similar to average fleet mileage standards – reduce average generation costs including cost of pollution).

7. Continue investment in university and college research toward targeted fields such as “green” energy, non-biodegradable plastics alternative, targeted biomedical projects, and new uses for the future abandoned telephone wire lines.

I am sure there will be other opinions because not many want to change the current way business is conducted until the model does not earn as expected. However, when the model stops earning as expected it is usually a sign of the end and is often too late to avoid dissolution or restructuring. I also realize that financial measures such as return are not totally applicable to management of government affairs, but another way to look at the arguments against government involvement is to question whether or not industry has returned in taxes the equivalent to expected return on investment/equity for its benefit from infrastructure development and maintenance.

May 1, 2009

Plantation Economics? [Metaphorical Narrative]

The recent 2008 elections have felt like a turning point in American history for many of us; and, much has been written about the current state of the conservatives and the Republican Party. The mantra of CHANGE unmistakably matched the sentiments of the American majority, but the GOP continues to struggle with its meaning. Most of the published ideas mentioned from Republican politicians have not changed at all.

GOP platform staples include (in simple abbreviated form): 1) Lower Taxes, 2) State’s Rights, 3) Small Government, and 4) Strong Military and a Global Projection of Power.

I have just finished reading a fantastic book by Malcolm Gladwell called Outliers which I recommend highly to all. In chapter six he tells the story of Harlan, Kentucky of the early eighteenth century and the high level of violence in the town as a result of the family feud between the Howards and the Turners. Gladwell states:

“We want to believe that we are not prisoners of our ethnic histories. But the simple truth is that if you want to understand what happened in those small towns in Kentucky in the nineteenth century, you have to go back into the past.”

Although I use this quote a bit out of context, it also applies to understanding the political platform positions of the current Republican party which is a southern-conservative party as reflected in the 2008 election results.

The GOP platform positions can be linked directly to Pre-civil war economies of the South and the Post-civil war social developments and political positions of the “dixiecrats” and their “southern strategy.” They left the Democratic party over the Civil Rights Act of 1964 and eventually joined the Republican Party.

Plantation owners held strong political influence in the South pre-civil war and ran their operations with tight controls demanding loyalty from all subjects. This plantation narrative provides a model to understand the political dynamics of Southern-Conservative politics. At this point, I think we are all familiar with the history of slavery. This history plays into, I believe, the current southern political perspective of labor. Minimize and eliminate opportunities for collaboration to challenge the authority of the Leader/Ruling Class/Strict Father figure (no labor unions). This authority is reinforced through biblical interpretation that allows dominion over the earth by God and government should not interfere with these activities (re: the Civil War). Labor is a business cost on the income statement that should be managed with all other input costs to increase profitability to the enterprise.

Further elaboration of this narrative provides that the Ruling Class is the source and creator of jobs and should not be taxed at any greater levels than the rest of the population. In fact, the government should invest into the businesses of this group through subsidies for greater economic prosperity. Therefore, eliminate most social programs to reduce the size and scope of the central government to focus on defense of the national interest through an overwhelming military presence.

The only problem with this platform is that it has been proven to not work and is ineffective at accomplishing any of its stated goals to improve, protect, and benefit all of American society.

My understanding of the strict father model is from the writings of George Lakoff from his book Don't Think of an Elephant: Know Your Values and Frame the Debate -- The Essential Guide for Progressives and his essay “Metaphor, Morality, and Politics, Or, Why Conservatives Have Left Liberals In the Dust.”

My understanding of the strict father model is from the writings of George Lakoff from his book Don't Think of an Elephant: Know Your Values and Frame the Debate -- The Essential Guide for Progressives and his essay “Metaphor, Morality, and Politics, Or, Why Conservatives Have Left Liberals In the Dust.”

Subscribe to:

Comments (Atom)

+Metrics.png)