Website Translator

January 25, 2011

January 16, 2011

Development and Economic Policy

The Issue with "Trickle Down" Ideology

Historical economic development of natural resources provided for the continuous improvement of living conditions of humanity through agricultural production, housing, fuels, transportation, and electricity generation among others. Early scale development allowed producers to efficiently grow and provide goods and services for the larger U.S. market. The basis for focused growth was expansion of available skills, training, and education. As human capital development expanded so did opportunities for economic growth and specialization. Consistent with the economic expansion was an evolving, socially inclusive based capital investment allocation via financial markets, entrepreneurial investors, and governments (federal and state). Inclusion of the larger population accelerated market growth and size through expanded wealth distribution and consumption.

Contrary to Democratic societal systems of capitalism, “Trickle Down” economic strategies attempt to consolidate financial capital within a market structure where allocation is focused solely on directed return interests. Benefits of the system "trickle down" to all other economic interests relative to the relationship to financial capital ownership. Another aspect of the ideology is the reduced role of government investment in industry via scientific research and education to provide a more distinctive limitation of Government - Industry regulatory inter-relations. The result of this strategy success would be the accumulation of financial capital within a single industry to determine investment decisions based upon a technical return calculation. Moreover, the country would be further segmented into economic benefit groups relative to development contribution factors limiting economic mobility opportunities.

An example of capital return benefits accumulation follows using a hypothetical scenario of citizen savings/investment and profit (return) distribution given a set of financial industry deposit decisions. In an attempt to reduce complexity, the scenario is based upon the Basic Summary of Business Process graphic presented in earlier discussions. The example analysis basis is the distribution of return on investment within the value chain of banking industry under the “Trickle Down” ideology of capital investment allocations and monetary concentrations (“bubbles”). The example reflects a regional commercial bank return of 15.4% based upon a loan with a 6.8% yield. The difference between the two returns is the accounting calculation. The bank transaction on the balance sheet would include a liability of $1,000,000 (savings/deposit) and assets of $900,000 (IB investment) for a net liability of $100,000 and profit on the liability of $78,503. However, the major point is the difference in return between the savings/investor and the banks (State and Federal Chartered/IB/Hedge Funds) where the proportion of profit sharing may vary somewhere between the 2.5% and 34.9% spread. Explicit in the example are the impacts of pricing gains (valuation) from increasing investment monetary levels and the beneficiaries resulting from the increase and the investment decisions relative to other opportunities. The financial capital concentration signals the need for an adjusted financial system model of “grant” awards identification and investment allocations into other development opportunities greatly expanding the focus.

Graphic documents support and reflect the relationship of topic themes previously discussed for comparison with social organizations, structure, and decision outcome impacts from general stereotype beliefs. I am planning to update the earnings data chart in which I applied the Development Metric methodology for additional commentary on human values, resources and ownership, and limitations (morality) of contractual (industry) terms agreement.

January 4, 2011

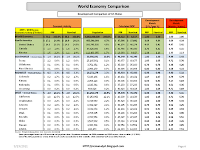

World Data Comparison III - Europe Economic Development Metric Analysis

Continuing with the usage of the Development Metric, the country listing from the quadrant analysis in the Social Spending and Economics and Assets and Values postings was amended adding the calculated metric. There were no new surprises but it does provide for a better evaluation, excluding earnings distribution, among the countries.[revision 11/17/2011]

---------------------------------------------------------------------------------------------------------------------

December 17, 2010

World Data Comparison II

While reviewing more data regarding development around the world, I wanted to find some comparative measure for usage when discussing growing economies and global competition. The leading developed nations and economic strengths in North America and Europe are common knowledge. Much attention has been placed upon the growth in developing countries with a current focus on China and Brazil. So, I decided to look at a relative comparison to assess the economic - political positions to society. For integrated societies with comparable stages of development and resources, there always exists the possibility of disagreement which could lead to non-optimal actions impacting global economies. However, the BRIC nations’ growth appears to be a natural stage of economic development consistent with the European and American enlightenment period when investment was focused upon Math, Sciences, and technological advancement. The US is still 4 times the development of China, but population size is important. China’s economy would be ~$60 Trillion at a similar level of development.

This comparison approach measures world economic activity percentage relative to world population percentage. The development position of economic strength increases as each nation educates and creates opportunity for all of its citizens.

December 15, 2010

U.S.A. Economic Development

As an extension of previous data analysis of world development, I looked at a comparative assessment of United States economic development as well as some countries around the world using available data from wikipedia and the CIA Fact Book. Primarily, it began as an initiative to find some relative measure to compare activity and levels of development regarding political discussions of states competing for corporate investment. Multiple factors are considered for such activity depending on the objective of the corporation and theoretically, an educated, multi-skilled work force has higher earnings.

The basic calculation of the measure is the state % of US economic activity divided by the state % of US population [US Basis]. I have additional work on a world basis for the upcoming World Data Comparison II updated blog post. The Development Metric provides a quick comparative level assessment of US development (regions and states). Since the total United States activity is the basis of measurement its metric is 1.00 relative to the individual states, although not reflected for reasons that may be obvious to some. The Metric of 4.44 and 5.37 is the World Economy basis Development Metric.

Obvious economic impacts are (1) the petroleum industry in Texas and Alaska; (2) finance industry in the Northeast; and (3) the political and lobby spending in DC (not a state but included anyway).

Subscribe to:

Comments (Atom)